One of the surest signs that a bubble is about to burst is junk bonds behaving like respectable paper. That is, their yields drop to mid-single digits, they start appearing with liberal loan covenants that display a high degree of trust in the issuer, and they start reporting really low default rates that lead the gullible to view them as ‘safe’. So everyone from pension funds to retirees start loading up in the expectation of banking an extra few points of yield with minimal risk.

One of the surest signs that a bubble is about to burst is junk bonds behaving like respectable paper. That is, their yields drop to mid-single digits, they start appearing with liberal loan covenants that display a high degree of trust in the issuer, and they start reporting really low default rates that lead the gullible to view them as ‘safe’. So everyone from pension funds to retirees start loading up in the expectation of banking an extra few points of yield with minimal risk.

This pretty much sums up today’s fixed income world. And if past is prologue, soon to come will be a brutally rude awakening. Most of the following charts are from a long, very well-done cautionary article by Nottingham Advisors’ Lawrence Whistler:

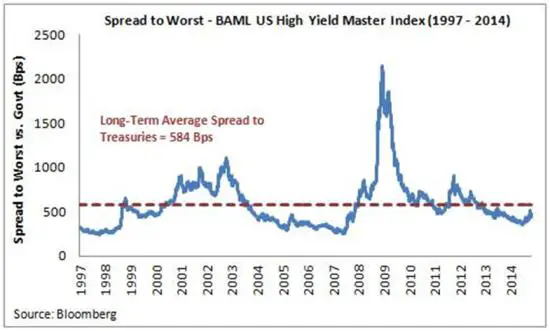

Junk yield premiums over US Treasuries are back down to housing bubble levels:

This post was published at DollarCollapse on November 18, 2014.

Follow on Twitter

Follow on Twitter

Recent Comments